Home Down Payments: A Big Hurdle for Buyers

Saving for a home down payment is a big challenge for many people. It now takes about seven years for a typical household to save for a down payment. This is better than the 12 years it took in 2022, but still a long time.

Down Payment Costs

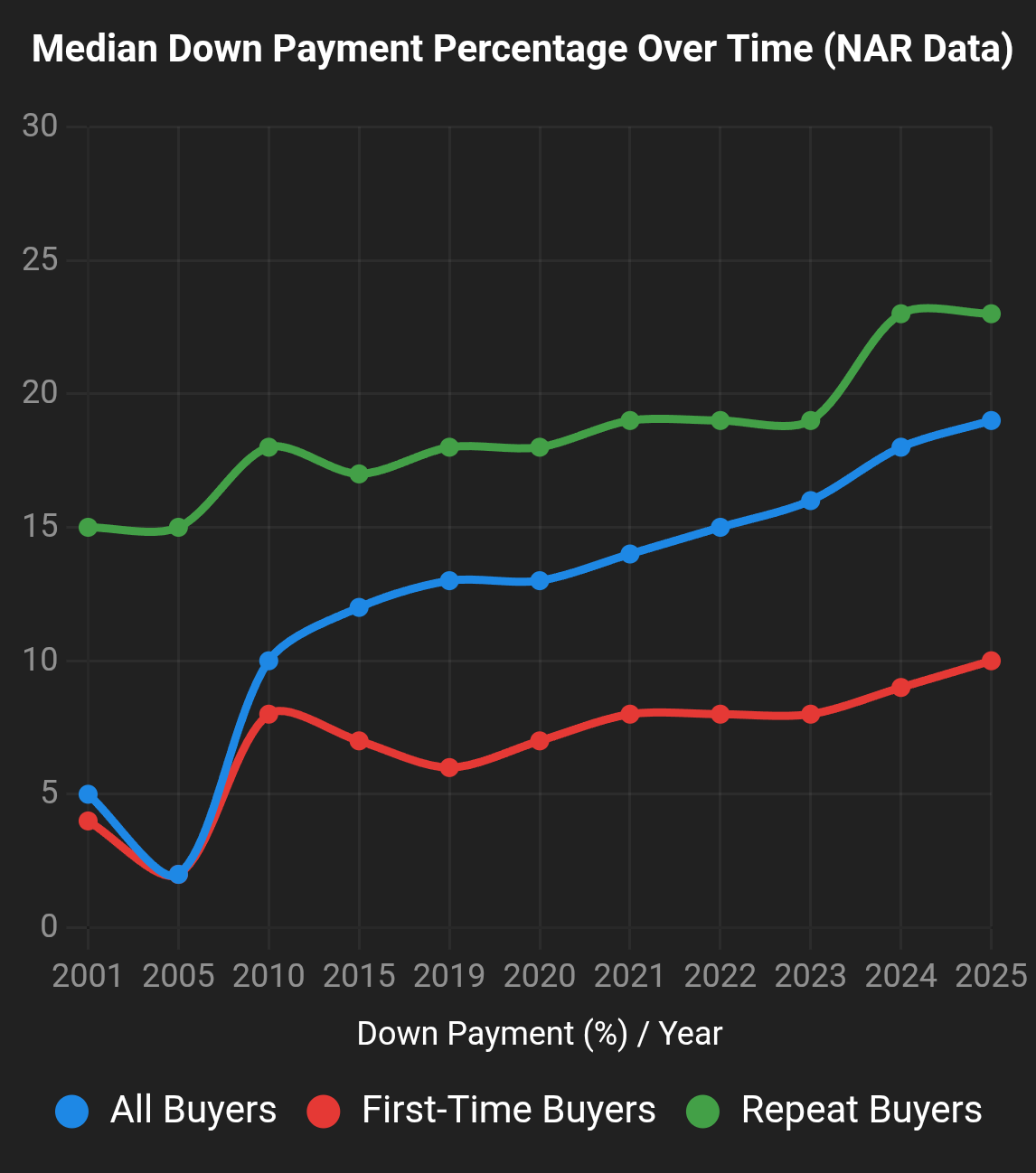

The cost of a down payment has gone up a lot. In the third quarter of 2025, the typical down payment was $30,400. This is more than double what it was before the pandemic. Higher home prices and more competition have driven up down payments. At the same time, inflation and rising household expenses have made it harder for people to save.

Savings Rates

The average household saves 5.1% of its income, which is lower than before the pandemic. This makes it even harder for people to save for a down payment. Some cities have much longer timelines to save for a down payment.

City Variations

Cities like San Francisco, San Jose, and Los Angeles have very long timelines to save for a down payment. In San Francisco, it takes 36.5 years to save for a down payment. The median down payment is over $245,000.

Shorter Timelines

Some cities have much shorter timelines to save for a down payment. San Antonio has the shortest timeline, at just 1.3 years. The median down payment there is $5,067. Other cities like Atlanta, Oklahoma City, and Houston also have shorter timelines.

Homeownership Challenges

In expensive cities, the down payment alone can be more than a year's worth of household income. This makes it very hard for people to buy a home, especially younger buyers.

Future Outlook

As the real estate market continues to change, it will be important to find ways to make homeownership more accessible. This could include new loan options or programs to help people save for down payments.

Stay Updated – Subscribe to Our Newsletter

Get the latest real estate news, market analysis, and housing insights delivered straight to your inbox.

No spam, ever. Unsubscribe anytime.Master Home Selling Strategies

Discover professional techniques to get top dollar for your property. Learn pricing psychology, staging secrets, and negotiation tactics that actually work.

Affiliate Disclosure: This is an affiliate link. We may earn a commission at no extra cost to you.

Get Home Selling Pro Now →DISCLAIMER: Content is for informational purposes only. Not financial, investment, or legal advice. Real estate investments carry substantial risks including market volatility and potential loss. Conduct your own research and consult qualified professionals before making financial decisions. We make no warranties regarding accuracy or completeness. Not liable for losses from use of this content. Affiliate Disclosure: Some links are affiliate links. We may earn commissions at no extra cost to you.